About Us

PRISM Bangladesh Foundation is a non-profit voluntary development organisation established in 1989 in the name of PRISM Bangladesh. PRISM started its socio-economic development activities for rural poor community in different areas of Bangladesh with the help of UN organisations like UNDP , UNICEF , UNDRO , etc. Simultaneously , PRISM has been increasing its development activities through implementing various programs and projects sponsored by many international and national agencies and organisations.

In the mean time , PRISM has implemented a large number of development programs and projects in various major development sectors like aquaculture , rural water supply and sanitation, socio-economic development , rural enterprise formation and capital development, relief and rehabilitation , disaster management programs , income generation and self employment ,

See more

Our Mission

The mission of PRISM is to foster local and family enterprises for increased production and income in poor rural communities. PRISM believes that human and natural resources exist in rural communities which needs to be evaluated from a new perspective for utilisation of their potentials. On the basis PRISM works as partners and equal participant with these communities.

PRISM researches unique ideas and develops them into innovative opportunities to increase productivity. PRISM wants to offer impoverished rural families a realistic alternative to either urban flight or further degradation of their environment. PRISM is , therefore , dedicated to creating sustainable , rural enterprises that provide the opportunity to work and prosper.

See more

News & Events

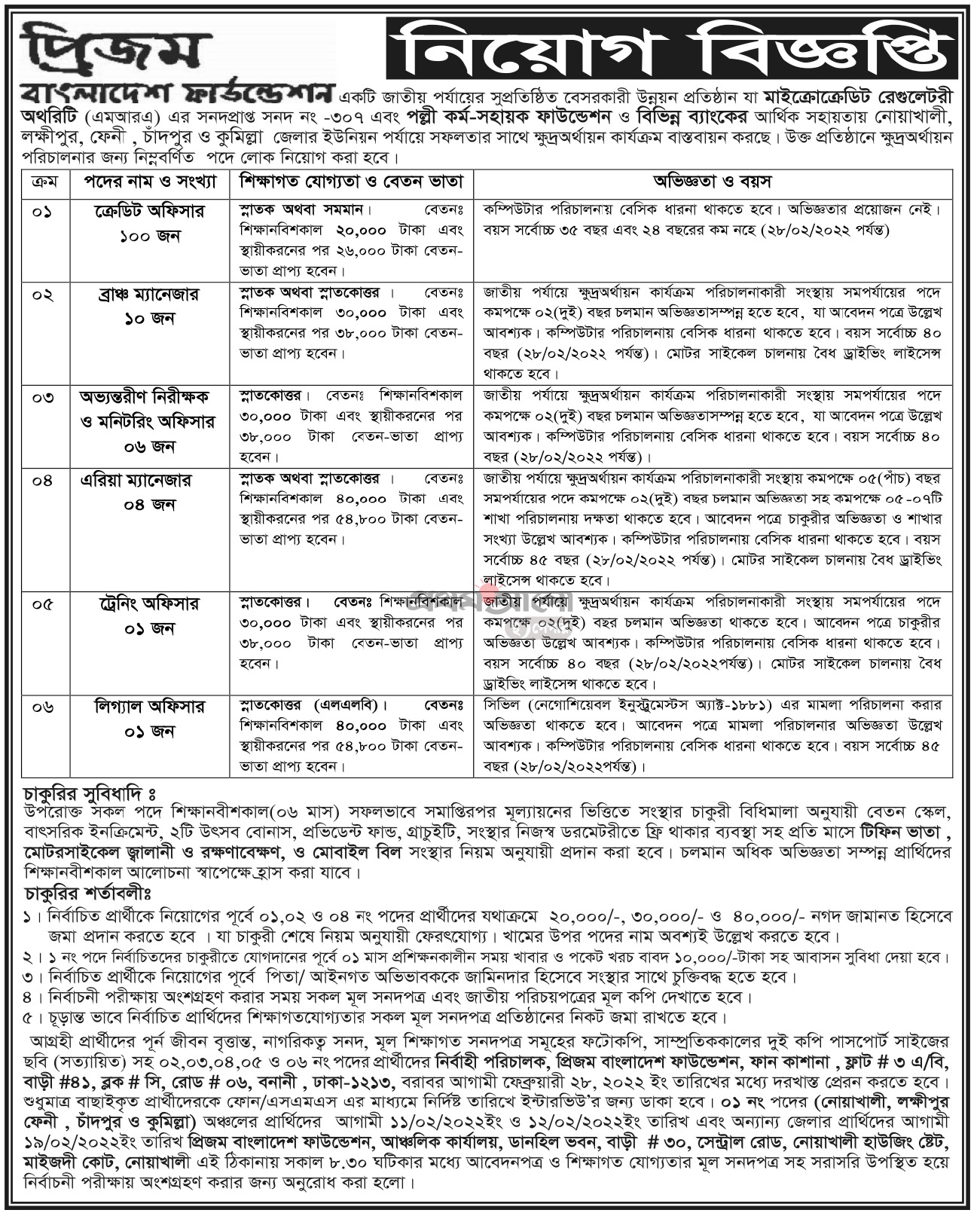

Job Circular/Vacancy Announcement - 2022.. see more